Tax Incentives Reduce Gunshot Detection Cost in 2022

Important Tax Information

Call your CFO! Thanks to the 2017 Tax Cuts and Jobs Act (TCJA), SDS customers can take advantage of a unique depreciation tax incentive which may significantly lower the cost of qualifying equipment purchased and placed into service in 2022. Why is this important now? 2022 is the last year of 100% accelerated depreciation for certain fixed assets and, unless Congress changes the law, the depreciation rates will drop off considerably in the coming years.

Are Security Systems Like Gunshot Detection Included?

SDS cannot provide tax advice and encourages you work with your finance team to fully assess this opportunity. But we can state that the TCJA modified the U.S. tax code’s section 179 to cover improvements made to nonresidential real property, covering alarm, security, and fire protection systems – including SDS’s industry leading products. More information can be found in this Security Industry Association (SIA) guide.

Act Before January 1, 2023

Why? Because 2022 is the last year that qualified businesses can utilize the 100% depreciation deduction. According to the current rules, the bonus depreciation will drop to 80% in 2023, 60% in 2024, 40% in 2025 and 20% in 2026. 100% depreciation on capital assets for these types of assets does not come along often so SDS recommends that any customers who are committed to protecting their employees, students or customers from active shooter events act now.

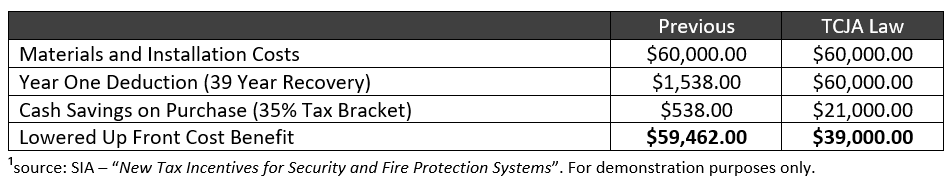

According to SIA’s guide¹, a sole proprietorship business who installed a fire alarm system in a 100,000 square foot building in 2022 could realize the following tax benefit:

Let Us Help You Reschedule

“Now is the time to green light your organization’s decision to add active shooter mitigation technology to your security portfolio,” says Rich Onofrio, Managing Director of Shooter Detection Systems. “We don’t want our customers to miss out on unprecedented savings like these.”

If you are already working with one of SDS’s Regional Sales Managers, just reach out to them to assist you in developing your 2022 plan. If you are not sure who to contact, one of our representatives can help you find the right person to talk to. Give us a call at 1-844-746-8911 or send an email to: [email protected]

Comment section